The Coronavirus (COVID-19) pandemic is having a far-reaching impact on all sectors of the global and Nigerian economy. The spread has grounded economic activities and the Real Estate sector is not isolated from it.

Contrary to the opinions of some critics that the sector would not be affected by the pandemic, which could be the reason governments pay little or no attention to the sector, operators explained that though the industry might not feel the effect now, especially in the second quarter of 2020, the impact would be felt before or by the end of the year.

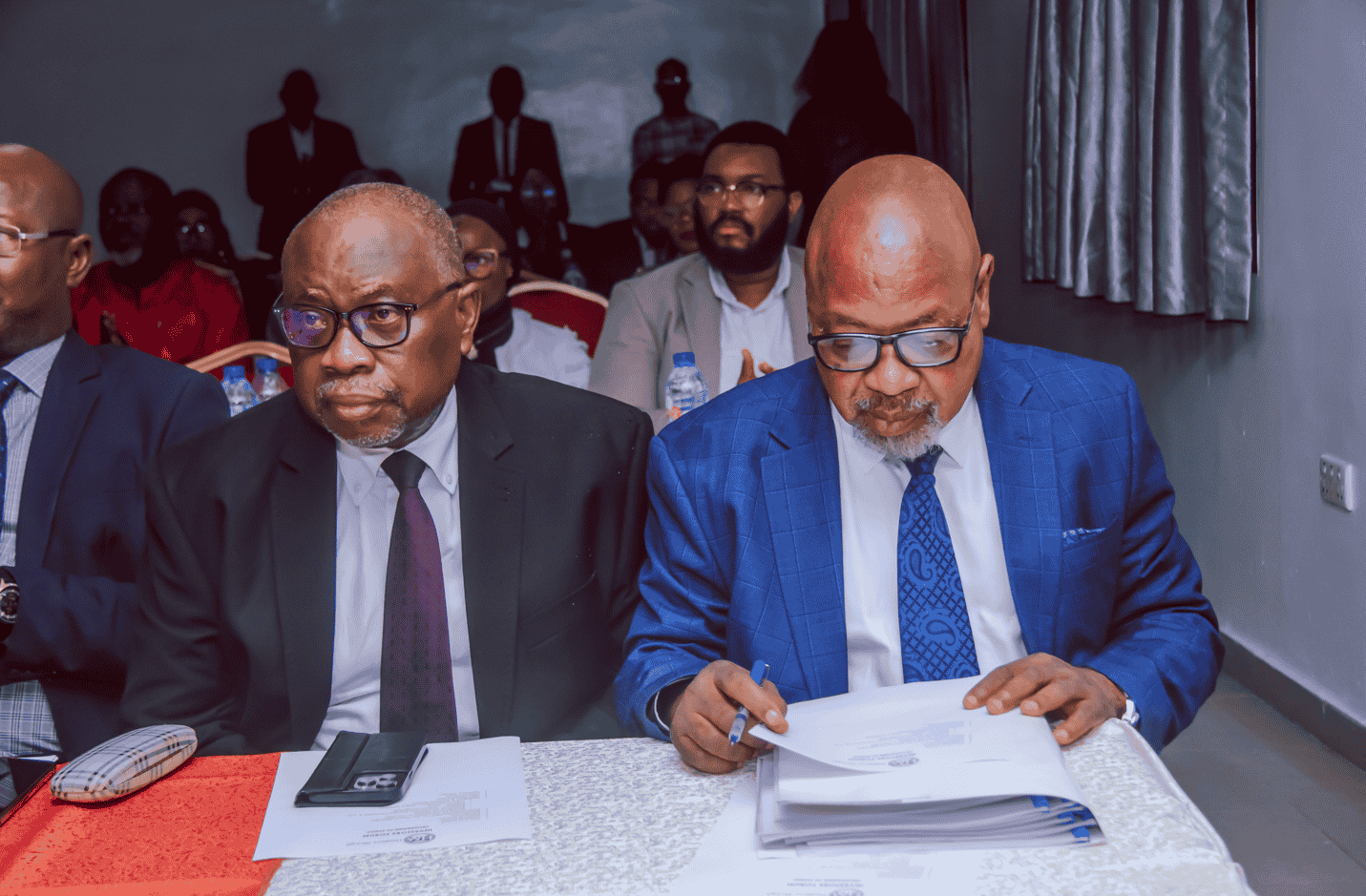

The Group Managing Director of Suru Worldwide Ventures, Edward Akinlade spoke at length on how the lockdown has changed the business outlook and how real estate players are adapting to the new normal

The Nobel corona virus has taught us many lessons in the last four months and in most areas of the real estate sector.

As of now, the most affected in the real estate is the Luxury market. Sales have monumentally gone down. Most real estates who deals only with luxury housing plan are most hit.

Affordable housing is still bundling along. This is a housing plan that falls between One million to Thirty million naira. The middle class is also struggling to stand as it depends on buyer’s capital investments or equity investments. This is how realtors get funding to develop properties in a considerably developed areas. The price range for middle-class housing plan is between N30 million to 60 million naira.

Things are happening in the middle income but one has to convince prospective buyer to run together.

Suru Group for instance has about 32 flats in Ketu and Bungalows at Mile 12.

We tell our buyers to invest 15 percent and we will cover the rest while the buyer spreads his balance across 24 months. This is how we have been able to adjust to the effect of the COVID-19.

We are also building hospitality structures within Lagos, at a very considerably affordable cost. We are bringing standard facility to Ketu for instance at a relatively cheap price, yet classy for the price.

We are also bringing quality housing and hospitality business in Ogolonto an outskirt of Ikorodu.

We have been able to invest more on the low income and middle income earners more than ever before because of the effect of the COVID-19.

You can see many high-rise building are now empty. People don’t go to work regularly as they used to.

Even at Suru Group, our staff don’t have to come to work to deliver on their respective job description. We have reduced office activities to Mondays, Wednesdays and Fridays. We have learnt that we don’t have to be in the office to do our works. So you see, to an extent, it will affect the need for more office structures.

Private realtors could have done more, but we need the immediate intervention of the government to support us. I should commend this administration for the initiation of the intervention fund of 300billion for real estate companies, and the single digit interest rate of 9%, which will go a long way to boost the real estate sector.

It will also allow us build enough low cost housing estates that will be affordable for most low income earners.