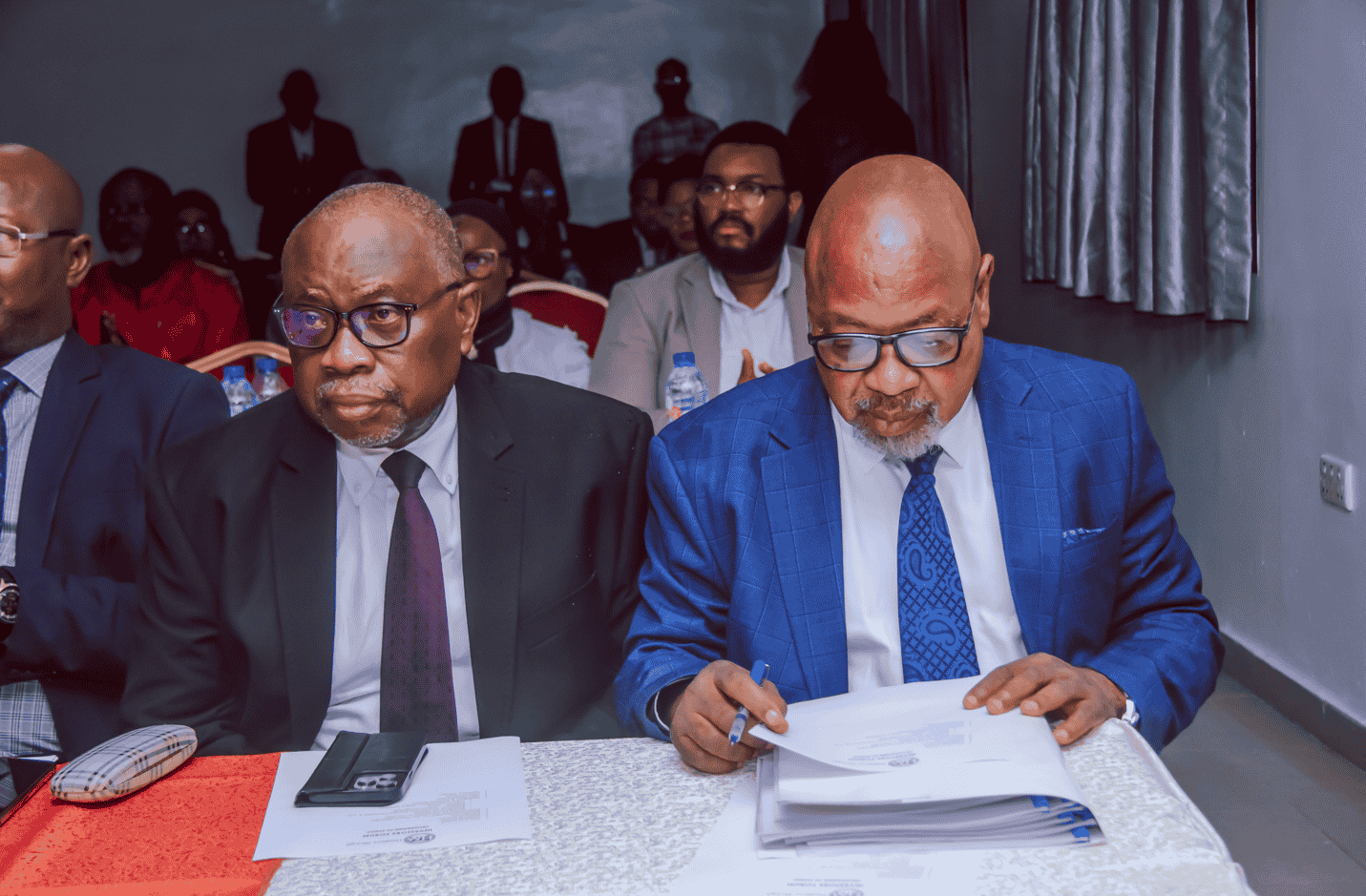

L-R: I.T. Director, Haldane McCall Plc, David Emuloh; HR Director, Sola Ojunde; Chairman, Chief George Ogunlade (SAN); Group Managing Director, Edward Akinlade and Hotel Director, Abiola Elugbaju, at the Board Meeting on Haldane McCall Plc’s plan to seek Listing on Nigerian Exchange Limited (NGX) in Lagos yesterday

The Group Managing Director, Haldane McCall, Dr Edward Akinlade, has disclosed the readiness of the company to harness the opportunities in the capital market to provide affordable homes for Nigerians given the economic challenges being faced by the country.

Akinlade, revealed this in an interview when asked the plan and motivation by the company for its proposed listing by introduction on the Nigerian Exchange Limited (NGX ).

He said: “ Well, our approach is completely different. First, we want visibility to expand our shareholder base and drive inflow through an array of opportunities for capital raising in the market in the future. As of now , we are going for listing by Introduction after receiving regulatory approvals by Securities and Exchange Commission (SEC) and Nigerian Exchange Limited (NGX). Then, we can sell our ideas, for example, to make affordable homes available for Nigerians. We also need visibility to sell our story, come up with capital raising options by equities or fixed income securities. We can leverage the opportunities enjoyed by listed companies to do huge affordable homes in Lagos and Abuja particularly. These are the two markets that we want to look into and don’t forget that there are so many abandoned building projects in these two locations while so many people are suffering for homes to live in, that is what we are going to use the money for.”

On why he thinks that it is profitable for any investor to buy the shares of the company when it eventually list, he said: “ Our future is based on what I would call a 10-year plan. Our master plan which spans 10 years, developed by Deloitte, speaks about being sustainable and profitable. We believe there will be capital growth in our shares. Another area we are looking at is making sure we pay dividends to our shareholders regularly.

” I investigated and found out that some of the real estate companies on the exchange had not paid a dividend for many years and I said it should not be so. Our policy on dividends is to pay out a minimum of 30 per cent of our net profit to shareholders. We will plough back 70 per cent. We will not ignore our shareholders. Our business plan is robust. Already, many investors are waiting for us to list on the exchange. They are excited to come and partner with us because they saw we have a story and vision. We have a formidable board that won’t be part of anything that is not robust enough.”, he explained .

Source: Tribune Online